In recent years, the Indian app development industry has seen tremendous growth, with many developers creating innovative apps that cater to the needs of Indian users.

However, with the growth of the industry comes increased regulation, and Indian app developers must comply with tax laws and other regulations.

In this article, we will explore how Indian developers on the Google Play Store can get their GSTIN and comply with tax laws.

What is GSTIN?

GSTIN stands for Goods and Services Tax Identification Number.

It is a unique identification number assigned to businesses that are registered under the Goods and Services Tax (GST) system in India.

GST is a comprehensive indirect tax that was introduced in India in 2017 to replace multiple indirect taxes levied by the central and state governments.

Read more:-

Samsung TVs Have the Google Play Store

“Remove China Apps” Taken Down By Google Play Store

Why is GSTIN important for Indian app developers on the Google Play Store?

Indian app developers who sell their apps on the Google Play Store are required to comply with Indian tax laws, including GST.

The Google Play Store requires developers to provide their GSTIN when they register to sell their apps.

This is because the Google Play Store acts as an intermediary between developers and buyers, and is therefore required to comply with Indian tax laws.

How can Indian developers on the Google Play Store get their GSTIN?

To get their GSTIN, Indian developers on the Google Play Store must first register for GST.

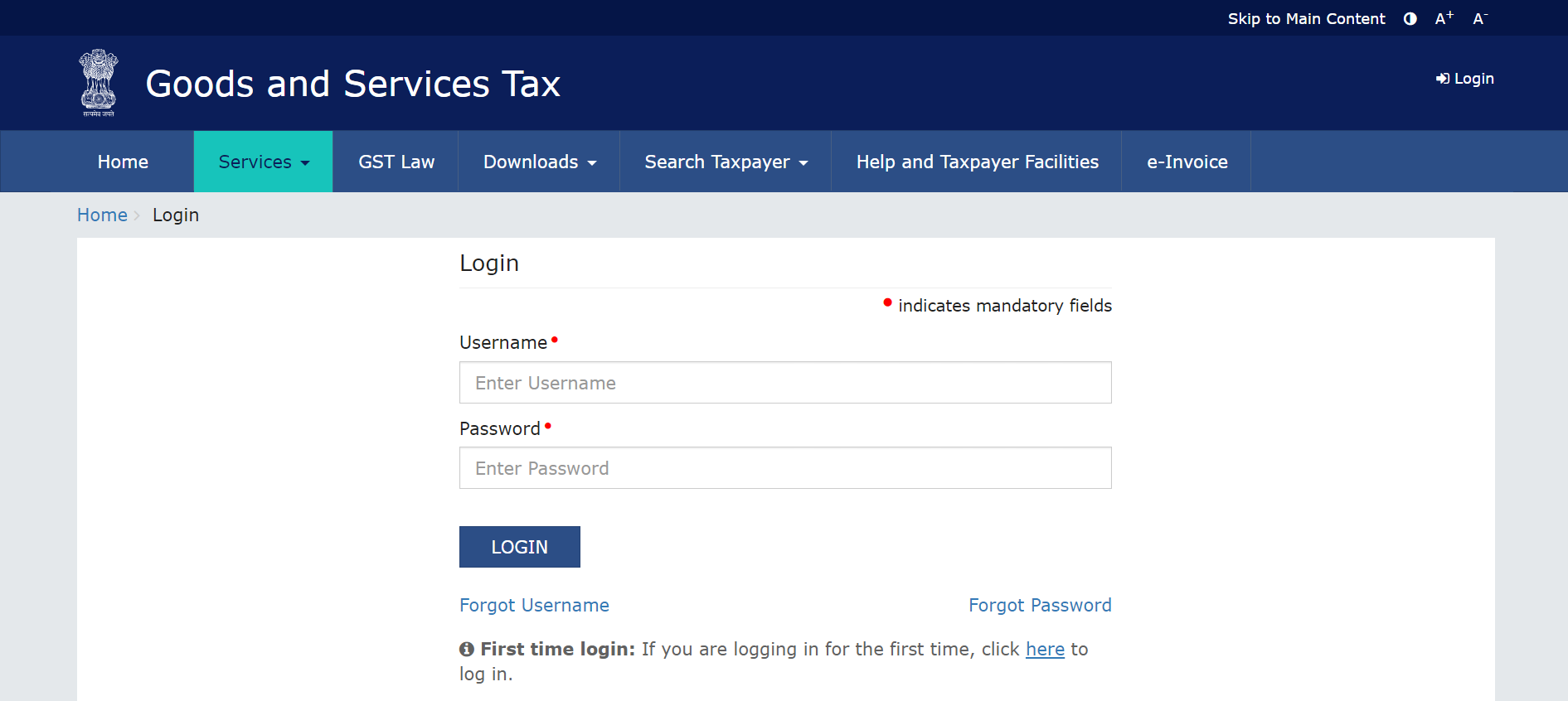

The registration process can be done online through the GST portal, which is maintained by the GST Network (GSTN).

The GSTN is a non-profit organization that manages the IT infrastructure for the GST system.

To register for GST, Indian app developers must provide their business details, including their legal name, PAN card details, and bank account information.

Once registered, they will receive their GSTIN, which they can then provide to the Google Play Store.

It is important for Indian app developers to ensure that they comply with all GST regulations, as failure to do so can result in penalties and fines.

The GST system in India is complex, and it is recommended that Indian app developers seek the help of a tax professional to ensure that they are in compliance with all regulations.

The GST registration process for Indian app developers:

To register for GST, Indian app developers must first visit the GST portal website and create an account.

They must provide their business details, including their legal name, PAN card details, and bank account information.

They must also provide their business address, email address, and phone number.

After providing all the necessary details, Indian app developers must upload supporting documents, such as their PAN card and proof of business address.

Once the application is submitted, the GSTN will review the application and issue a GSTIN to the developer if all the details are found to be correct.

The time taken for the GST registration process varies depending on the complexity of the application and the accuracy of the information provided.

In some cases, the registration process can be completed within a few days, while in others it may take several weeks.

Read more:-

“Editor’s Choice” Meaning In Google PlayStore

Huawei Phones Still Have The Google PlayStore

The importance of compliance with Indian tax laws:

Compliance with Indian tax laws, including GST, is crucial for Indian app developers on the Google Play Store.

Failure to comply with tax laws can result in penalties and fines, which can be significant.

Additionally, non-compliance can damage the reputation of the developer and their app, leading to a loss of customers and revenue.

It is important for Indian app developers to seek the help of a tax professional to ensure that they are in compliance with all tax laws and regulations.

Tax professionals can provide guidance on the GST registration process, as well as advice on tax planning and compliance.

The benefits of compliance with Indian tax laws:

Compliance with Indian tax laws, including GST, has several benefits for Indian app developers.

Firstly, it ensures that the developer is operating legally and can continue to sell their apps on the Google Play Store.

Secondly, compliance can help to build trust and confidence among customers, who are more likely to purchase apps from developers who are in compliance with all regulations.

Thirdly, compliance can help to avoid penalties and fines, which can be significant and can impact the financial health of the business.

Read more:-

Useful or Interesting Applications In Google PlayStore

Malicious Applications On Google Play Store

Conclusion:

In conclusion, Indian app developers on the Google Play Store must comply with Indian tax laws, including GST.

To do so, they must register for GST and obtain their GSTIN. The GST registration process can be done online through the GST portal, but it is recommended that Indian app developers seek the help of a tax professional to ensure that they are in compliance with all regulations.

Compliance with Indian tax laws has several benefits for Indian app developers, including legal compliance, customer trust, and financial stability.

By complying with Indian tax laws, Indian app developers can continue to contribute to the growth of the Indian app development industry.

In conclusion, Indian app developers on the Google Play Store must comply with Indian tax laws, including GST.

To do so, they must register for GST and obtain their GSTIN. The registration process can be done online through the GST portal, and it is recommended that Indian app developers seek the help of a tax professional to ensure that they are in compliance with all regulations.

By complying with Indian tax laws, Indian app developers can ensure that they are operating legally and can continue to contribute to the growth of the Indian app development industry.